michigan gas tax rate

Diesel is 287 cents per gallon. Michigan Gas Tax 17th highest gas tax.

Highest Gas Tax In The U S By State 2022 Statista

On top of excise taxes many states also apply fees and other taxes including environmental fees inspection fees.

.png)

. On a single gallon of gasoline at 403 per gallon youd pay 18 cents for federal 27 cents for the state motor tax and 22 cents for the sales tax. 145 average effective rate. Gasoline is 209 cents per gallon.

Returns not filed timely are subject to the late filing penalty and interest provisions. Michigan severance tax returns must be filed monthly by the 25th of the month following the production. 7521 Westshire Drive Suite 200.

The Federal gasoline tax 184 cents per gallon the Michigan sales tax levied at a rate of 60 on a base. 2020 Millage Rates - A Complete List. View the Current Notice of Prepaid Sales.

The Michigan excise tax on gasoline is 1900 per gallon higher then 66 of the other 50 states. State Motor Fuel Tax. Other Michigan Fuel Excise Tax Rates The primary excise taxes on fuel in Michigan are on.

Avalara can simplify fuel energy and motor tax rate calculation in multiple states. What is Michigans gas tax now. The tax rates for Motor Fuel LPG and Alternative Fuel are as follows.

If a gallon of gas costs 320 you would be paying 184 cents federal tax plus the 263 cents state tax and an additional 17 cents in Michigan sales tax. How does the Michigan gas tax work. Information on natural gas service and rates for residential customers in Michigan.

These taxes are included in the price of fuel purchased at the pump This memo provides background information on taxes imposed on motor fuels in Michigan. If a gallon of gas costs 320 you would be paying 184 cents federal tax plus the 263 cents state tax and an additional 17 cents in Michigan sales tax. 2018 Millage Rates - A Complete List.

In Michigan the average regular gas price is 425 per gallon as of Wednesday afternoon on par with the national average according to the American Automobile. The state excise tax is 75 cpg on gas and diesel additional 138 ppg state sales tax on diesel 118 ppg state sales tax on gasoline. Motor Fuel Taxes In Michigan three taxes are included in the retail price of gasoline.

2021 Millage Rates - A Complete List. Michigans excise tax on gasoline is ranked 17 out of. 2015 an out-of-state seller may be required to.

Michigan State Tax Quick Facts. The average local income tax collected as a percentage. 2019 Millage Rates - A Complete List.

See the current motor fuel tax rates for your state as of September 2022. Michigan natural gas rates. 4 of gross cash market value.

Ad Avalara solutions can help you determine energy and fuel excise tax with greater accuracy. Taxes in Michigan. Michigan Business Tax 2019 MBT Forms 2020 MBT Forms.

For fuel purchased January 1 2017 and through December 31 2021 Gasoline 263 per gallon Diesel Fuel 263 per gallon. Michigan Gas Choice allows you to choose your natural gas. This would bring your.

Michigan Gasoline Tax. Effective October 1 2022 through October 31 2022 the new prepaid sales tax rate for. 26 rows Gasoline and Diesel Tax rates also include a 8-875 cpg state sales tax 4 local sale.

Tax To Retail. Gas and Diesel Tax rates are rate local sales tax varies. Prepaid Fuel Sales Tax Rates.

Notice Concerning Inflation Adjusted Fuel Tax Act and Applicable to IFTA Motor Carriers That Will Take Effect on January.

See How Much A 45 Cent Michigan Gas Tax Might Cost You Bridge Michigan

Motor Fuel Taxes Urban Institute

Michigan Senate Approves Suspension Of State S 27 Cent Gas Tax Mlive Com

Michigan S Gas Tax How Much Is On A Gallon Of Gas

Michigan Gas Prices Up 4 Cents In Last Week Aaa Reports

Whitmer Vetoes Gop Bill That Would Lower Michigan Income Tax Rate

Michigan House Dem Leader Says Whitmer S 45 Cent Gas Tax Is Probably Dead Bridge Michigan

Michigan Senators Seek Summer Pause On Gas Taxes Gov Gretchen Whitmer Encouraged Bridge Michigan

State Motor Fuel Tax Rates The American Road Transportation Builders Association Artba

Michigan Gas Tax Hike Coming In 2022

These States Have The Highest And Lowest Gas Taxes As Biden Pushes Tax Holiday

Michigan Senate Passes Second Attempt At State Gas Tax Holiday State Abc12 Com

Michigan Prepaid Gas Sales Tax Rate Change Avalara

Gas Tax By State 2022 Current State Diesel Motor Fuel Tax Rates

Gas Tax Rates By State 2020 State Fuel Excise Taxes Tax Foundation

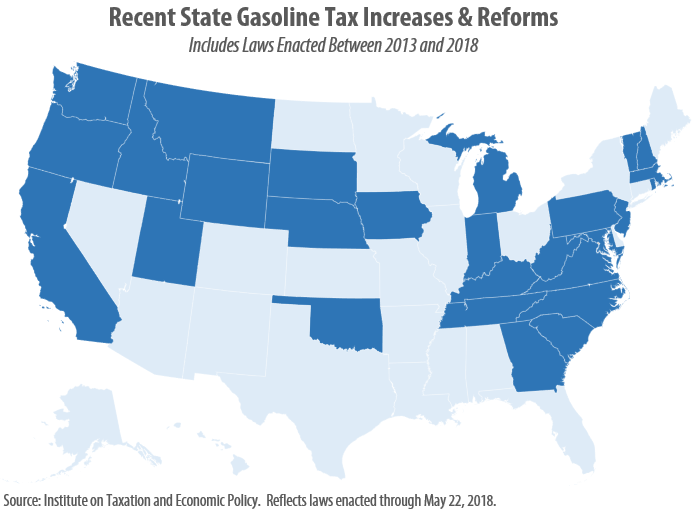

Most States Have Raised Gas Taxes In Recent Years Itep

Gov Whitmer Vetoes Legislation To Suspend Michigan S 27 Cent Gas Tax Mlive Com

Michigan Governor Gretchen Whitmer Proposes Gas Tax Increase

Fact 900 November 23 2015 States Tax Gasoline At Varying Rates Department Of Energy